Your Reliable List of hard money lenders in Atlanta Georgia

Your Reliable List of hard money lenders in Atlanta Georgia

Blog Article

Exploring the Advantages and Dangers Related To a Hard Money Lending

Navigating the complex globe of actual estate funding, financiers frequently come across the choice of a Hard Money Finance. The crucial lies in comprehending these facets, to make an educated choice on whether a Hard Money Financing fits one's financial strategy and threat resistance.

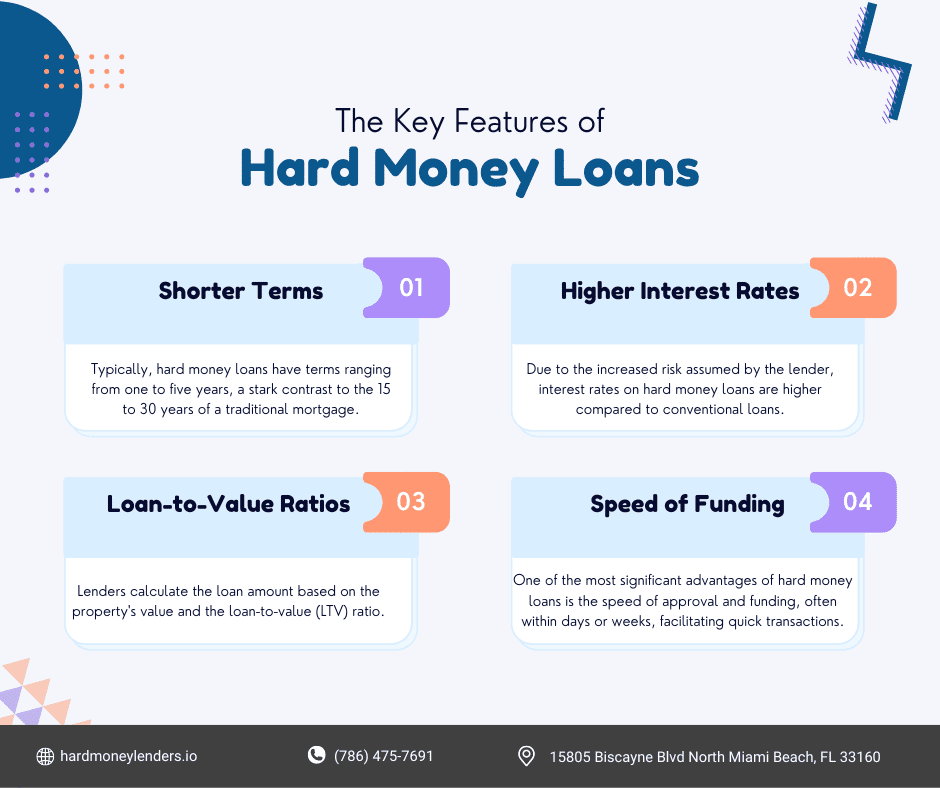

Comprehending the Basics of a Hard Money Lending

What exactly is a Hard Money Finance? Unlike typical bank car loans, difficult Money financings are based primarily on the value of the residential property being acquired, instead than the consumer's credit rating score. These finances are typically utilized for investment purposes, such as house flipping or development projects, instead than individual, household use.

Trick Conveniences of Opting for Hard Money Loans

Possible Risks and Downsides of Tough Money Fundings

Despite the attractive advantages, there are some significant dangers and disadvantages related to tough Money financings. These car loans usually come with high rates of interest, sometimes dual that of traditional fundings. This can result in economic pressure otherwise managed correctly. In addition, hard Money finances generally have shorter payment durations, generally around twelve month, which can be testing for borrowers to meet. Furthermore, these lendings are commonly safeguarded by the borrower's building. They risk shedding their building to repossession if the customer is unable to repay the Financing. Last but not least, difficult Money lending institutions are much less controlled than conventional lenders, which might subject customers to unethical borrowing techniques. Thus, while tough Money lendings can give quick funding, they additionally lug substantial dangers. hard money lenders in atlanta georgia.

Instance Circumstances: When to Think About a Hard Money Loan

Contrasting Hard Money Lendings With Various Other Funding Options

How do tough Money loans stack up against various other funding alternatives? When compared to typical financings, hard Money fundings supply a quicker authorization and funding process because of fewer laws and requirements. However, a knockout post they commonly feature greater rates of interest and charges. On the other hand, small business loan use reduced rate of interest prices but have strict qualification requirements navigate to these guys and a slower approval time. Private fundings, on the various other hand, deal flexibility in terms however might lack the structure and safety of difficult Money finances. Last but not least, crowdfunding and peer-to-peer borrowing systems use a special option, with competitive prices and convenience of accessibility, however may not appropriate for larger funding requirements. Therefore, the option of financing relies on the consumer's certain requirements and scenarios.

Verdict

In final thought, tough Money fundings offer a feasible remedy genuine estate capitalists requiring swift and versatile funding, specifically those with credit rating difficulties. The high interest prices and shorter payment durations demand careful consideration of prospective dangers, such as repossession. It's essential that customers completely review their economic strategy and danger tolerance prior to deciding for this sort of Funding, and compare it with other funding alternatives.

Unlike standard financial institution loans, difficult Money financings are based primarily on the value of the building being purchased, instead than the consumer's credit scores rating. These lendings typically come with high passion prices, sometimes double that of standard fundings. In scenarios where a borrower wants to avoid a lengthy Finance procedure, the extra straightforward hard Money Lending application can provide an extra hassle-free choice.

When contrasted with traditional lendings, difficult Money financings supply a quicker approval and financing process due to less needs and guidelines - hard money lenders in atlanta georgia. Private loans, on the various other hand, offer adaptability in terms however might lack the framework and protection of difficult Money finances

Report this page